Unknown Facts About Truck Insurance In Dallas Tx

Wiki Article

Home Insurance In Dallas Tx Fundamentals Explained

Table of ContentsA Biased View of Commercial Insurance In Dallas TxThe Basic Principles Of Home Insurance In Dallas Tx The 20-Second Trick For Truck Insurance In Dallas TxInsurance Agency In Dallas Tx Fundamentals ExplainedThe 3-Minute Rule for Health Insurance In Dallas TxGetting The Commercial Insurance In Dallas Tx To Work

As well as since this coverage lasts for your entire life, it can help sustain long-lasting dependents such as children with disabilities. Disadvantage: Cost & intricacy an entire life insurance plan can be considerably more pricey than a term life policy for the very same death advantage amount. The cash money value component makes entire life a lot more complicated than term life because of costs, taxes, passion, as well as various other terms.

Cyclists: They're optional add-ons you can utilize to personalize your policy. Some policies come with riders automatically included, while others can be included at an added price. Term life insurance policy plans are generally the most effective remedy for individuals that need cost effective life insurance policy for a details duration in their life.

Life Insurance In Dallas Tx for Beginners

" It's always suggested you talk to a licensed agent to figure out the very best service for you." Collapse table Now that you know with the fundamentals, below are added life insurance policy plan types. A lot of these life insurance coverage choices are subtypes of those featured over, suggested to serve a specific purpose.Pro: Time-saving no-medical-exam life insurance policy gives much faster accessibility to life insurance policy without needing to take the clinical test (Truck insurance in Dallas TX). Disadvantage: Individuals who are of old age or have numerous wellness problems may not be eligible. Best for: Any individual who has few health problems Supplemental life insurance policy, likewise referred to as voluntary or voluntary additional life insurance coverage, can be used to connect the protection space left by an employer-paid group plan.

Unlike various other policy kinds, MPI just pays the survivor benefit to your mortgage lender, making it a a lot more restricted option than a typical life insurance policy plan. With an MPI policy, the recipient is the home loan company or loan provider, rather than your family members, and the fatality benefit reduces in time as you make mortgage settlements, similar to a lowering term life insurance policy plan.

The Main Principles Of Home Insurance In Dallas Tx

Due to the fact that AD&D only pays out under specific conditions, it's not an ideal alternative to life insurance policy. AD&D insurance policy just pays if you're hurt or killed in a crash, whereas life insurance policy pays for a lot of reasons of death. As a result of this, AD&D isn't appropriate for everybody, however it may be useful if you have a high-risk profession.

Not known Details About Home Insurance In Dallas Tx

Best for: Pairs that don't receive two private life insurance policy plans, There are 2 primary kinds of joint life insurance policy plans: First-to-die: The policy pays out after the first of the two spouses dies. First-to-die is one of the most comparable to an read this article individual life insurance policy policy. It assists the making it through policyholder cover expenditures after the loss of financial support.Then, they'll be able to assist you compare life insurance policy suppliers swiftly and easily, and also find the finest life insurance company for your circumstances. What are the 2 primary sorts of life insurance coverage? Term and irreversible are the 2 primary sorts of life insurance. The primary distinction in between both is that term life insurance policies have an expiry date, giving insurance coverage in between 10 and also 40 years, as well as long-term plans never end.

Both its duration and cash money value make irreversible life insurance policy often times much more expensive than term. What is the most affordable sort of life insurance policy? Term life insurance policy is usually one of the most economical as well as comprehensive kind of life insurance policy since it's simple as well as provides economic defense throughout your income-earning years. Exactly how much you visit homepage pay for life insurance, nonetheless, will certainly depend upon your age, gender, lifestyle, and also health and wellness.

Rumored Buzz on Truck Insurance In Dallas Tx

Whole, global, indexed global, variable, and interment insurance policy are all kinds of permanent life insurance coverage. Irreversible life insurance normally comes with a cash money value as well as has greater costs.life insurance policy market in 2022, according to LIMRA, the life insurance research organization. Term life premiums represented 19% of the market share in the very same period (bearing in mind that term life costs are much less costly than entire life costs).

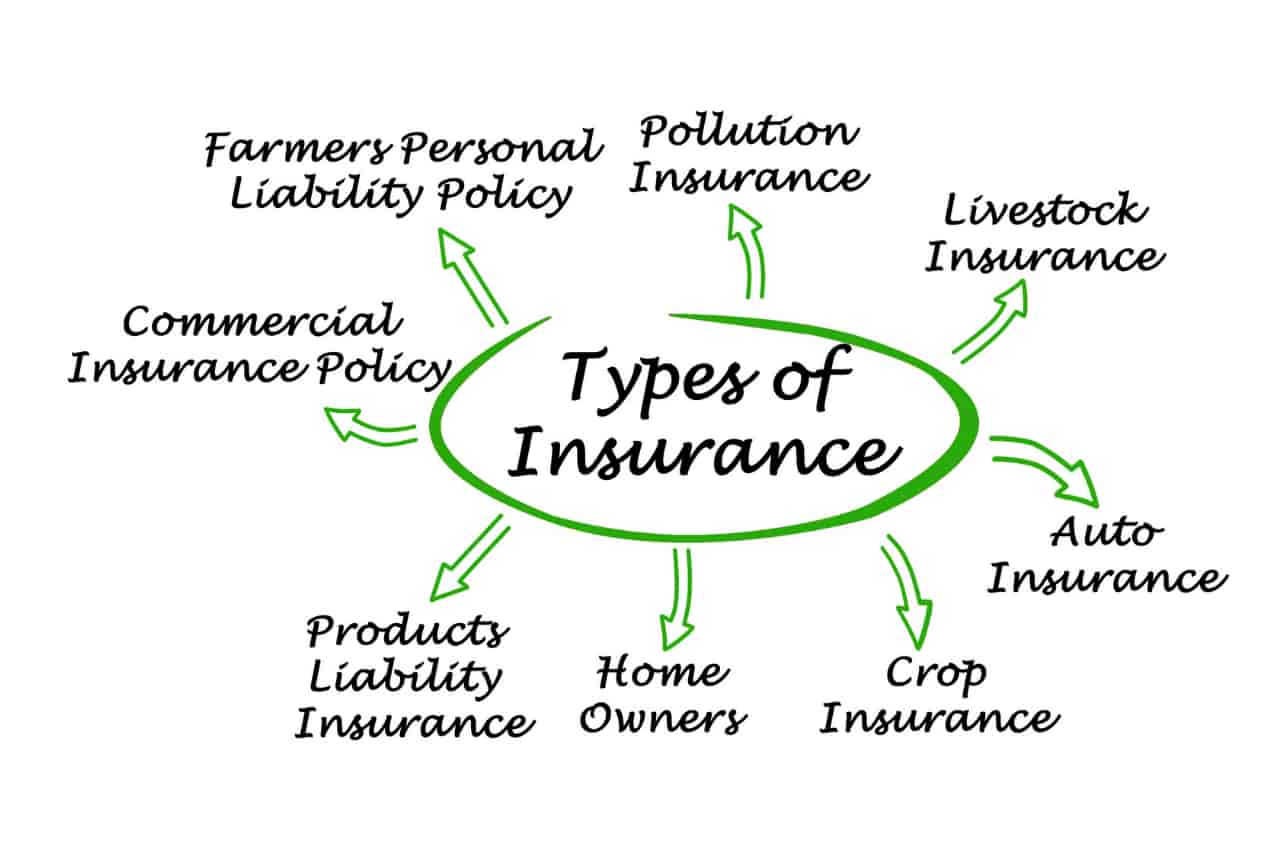

There are 4 fundamental parts to an insurance coverage contract: Statement Page, Insuring Agreement, Exemptions, Problems, It is very important to comprehend that multi-peril policies might have details exclusions and problems for each kind of protection, such as collision coverage, clinical repayment coverage, responsibility protection, and more. You will certainly require to ensure that you read the language for the details protection that applies to your loss.

The Buzz on Health Insurance In Dallas Tx

g. $25,000, $50,000, and so on). This is a recap of the significant assurances of the insurance coverage company and specifies what is covered. In the Insuring Contract, the insurer agrees to do certain things such as paying losses for covered perils, offering specific services, or agreeing to protect the guaranteed in a responsibility lawsuit.Examples of left out property under a property owners policy are personal residential property such as a vehicle, an animal, or an airplane. Conditions are provisions put in the plan that certify or put limitations on the insurance provider's guarantee to pay or carry out. If the plan problems are not satisfied, the insurance provider can deny the claim.

Report this wiki page